Federal Direct Student Loans

Federal Direct Student Loans are borrowed money that must be repaid.

The Federal Direct Loan Program makes low-interest loans available to dependent and independent students who are enrolled for at least six credits per semester. Students may be eligible for a subsidized and/or unsubsidized Federal Direct Loan as determined by the college.

- Subsidized Loans (based on financial need): The Federal Government pays the interest on these loans while the student is in school or in a period of deferment.

- Unsubsidized Loans: The student pays the interest after the loan is disbursed until he or she repays the loan in full.

Federal Direct Loan Limits

| Dependent Students | Base Amount | Additional Unsubsidized Loan Amount |

|---|---|---|

| Freshman (0-30 credits) | $3,500 | $2,000 |

| Sophomore (31 or more) | $4,500 | $2,000 |

| Independent Undergraduate Students | Base Amount | Additional Unsubsidized Loan Amount |

|---|---|---|

| Freshman (0-30 credits) | $3,500 | $6,000 |

| Sophomore (31 or more) | $4,500 | $6,000 |

Aggregate Loan Limits

- Undergraduate Dependent Students: $31,000 (of which $23,000 can be subsidized)

- Undergraduate Independent Students: $57,500 (of which $23,000 can be subsidized)

To apply for a Federal Direct Loan:

- Complete Entrance Counseling (for an undergraduate student) and a Master Promissory Note online at https://studentaid.gov/entrance-counseling/

- For spring-only or summer-only loans, submit a request via email to finaid@lee.edu.

If we can determine that a student has had a prior Federal Direct Loan, we will not require the completion of the Federal Direct Loan entrance counseling. However, a Master Promissory Note is required for each school.

Once the Financial Aid Office can confirm you have completed the entrance counseling and Master Promissory Note, we will place on your myLC account an offer that you must accept before funds can be processed.

Deadlines

Students must submit the federal loan request two weeks before the end of the semester in which they are enrolled. Unless the student attended at an eligible level during the fall semester, the fall/spring request can be submitted two weeks before the end of the spring semester. Allow approximately 30 days for processing. Loans awarded before the billing due date will hold course registration only if the amount is enough to cover their costs.

Disbursement and Refunds for Loans

Disbursement means that all eligible financial aid funds will be posted to your account as a payment for classes.

See the Disbursement and Refund schedule page.

Registering for classes with different start dates will affect how long it takes to verify attendance for the 6-credit-hour requirement. For example, if you are taking 6 credit hours with one regular term class and one second-start class, your loans will not disburse until attendance is verified for the second-start class.

Loan requirements must be completed before loans can disburse and refund.

- Accept your Award.

- Be enrolled and attending 6 or more credit hours on your degree/certificate plan.

- Complete the Loan Entrance Counseling.

- Complete the Master Promissory Note.

A Few Things That Affect Disbursement Schedule

- SCHEDULE CHANGE: If your schedule changes and you enroll in later-start classes, your scheduled disbursement week will change. Contact the campus financial aid office for those details.

- WITHDRAWALS:Withdrawing from classes will have an impact on the scheduled disbursement. If you withdraw from class(es), all aid will be held for review, and eligibility may need to be recalculated. Contact the campus financial aid office for those details.

- LOAN REQUIREMENTS: To receive a disbursement for loans, you must meet the requirements listed above.

- ONE-SEMESTERLOANS: If your loan is for one semester only, you will receive two payments within that semester. Contact the campus financial aid office for those details.

Loan Exit Counseling

If you have received Federal Direct Loans at Lee College and have graduated or will transfer, you are required to complete exit counseling. You may complete this counseling online at https://studentaid.gov/exit-counseling/.

Loan History

Students who would like to view their borrowing history or have questions about payments, previous loans or default resolution may visit www.nslds.gov to view information and obtain contact information for lenders and servicers.

Repaying your Student Loans

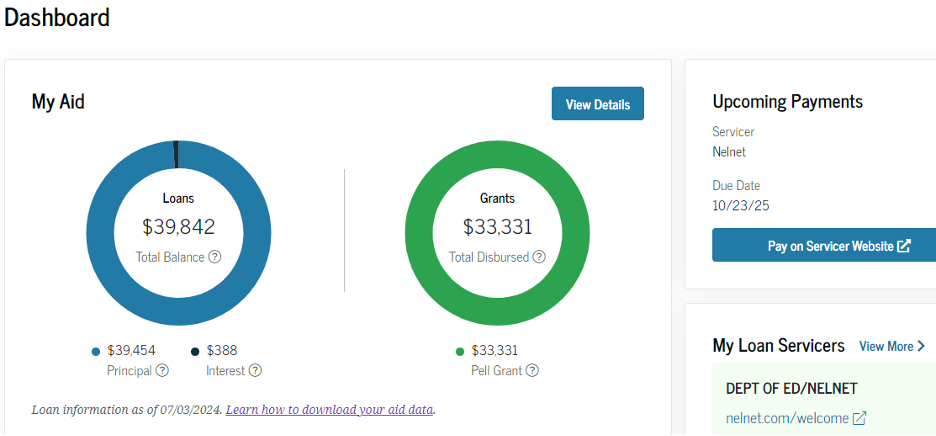

Before you begin, know that all information pertaining you your specific loan(s), repayment, your servicer, the mandatory exit interview and the steps you need to take upon graduation, leaving school, or, if you've dropped below half-time enrollment, is available by logging in to your student aid account at www.studentaid.gov. Once you log in, your dashboard should display any aid you have received/borrowed, as well as your payments and/or servicer information. There is also an option to download you aid data: https://studentaid.gov/help-center/answers/article/how-can-i-download-my-aid-data.

When do I begin paying back my loan?

After you graduate, leave school, or drop below half-time enrollment, you will have a six-month grace period before you must begin repayment. During this period, you will receive repayment information from your loan servicer, and you will be notified of your first payment due date. Payments are usually due monthly, and it is important that your contact information is correct so you can be contacted when it is time. If your servicer is unable to contact you, you could default on your loans and hurt your future financial aid and/or your credit.

What are the interest rates?

The interest rate varies depending on the loan type and (for most types of federal student loans) the first disbursement date of the loan. Current interest rates can be found at https://studentaid.gov/understand-aid/types/loans/interest-rates.